服务项目

传统的购买和处置不良资产包操作流程如下:

意向购买方先与银行洽谈购买不良资产包的意向,银行会甩出一个资产包并给出一份资产清单,并要求意向方签订保密协议;随后意向方与银行一起查看资产包内抵押物和各贷款项目的状况;意向方自己做尽职调查,完毕后去银行对该资产包竞标,竞标后通过四大AMC通道去购买该资产包,并进行后期的资产处置。

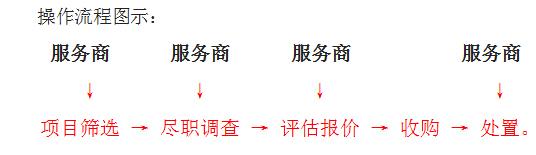

操作流程图示:项目筛选→尽职调查→评估报价→收购→处置。

由于前期尽职调查工作非常辛苦,工作量很大,要投入很多当地的资源。同时因为信息不透明,资产包内资产所有权不明晰,意向购买方很难在短期内作出有效判断。而尽职调查主要包括法律尽职调查和财务尽职调查两部分。法律尽职调查主要是分清每笔资产在债权上是否存在瑕疵,有无其他诉讼和涉刑事案件情况;财务尽职调查涉及的内容则更多更复杂,要调查债务人是否存在,该笔资产的本金和利息还款情况,借款人的还款能力,抵押物和担保情况,抵押物变现能力,抵押物处置的流动性问题等等。整个尽职调查过程时间长,效率低。

引入不良资产服务提供商的操作流程如下:

意向购买方先与银行洽谈购买不良资产包的意向,银行会甩出一个资产包并给出一份资产清单,并要求意向方签订保密协议;随后意向方委托服务商查看资产包内抵押物和各贷款项目的状况;意向方委托服务商进行做尽职调查,完毕后去银行对该资产包竞标,竞标后通过四大及地方性AMC通道去购买该资产包,并委托服务商进行后期的资产处置。

我公司可以根据委托方需求在整个不良资产包收购处置的各个环节中提供以下单独或整体的打包服务。

具体各环节的服务项目如下:

项目筛选:项目来源、卖方情况、法律瑕疵、潜在回报率初期预估、竞争对手分析、

尽职调查:原债权债务背景资料调查、资产现场勘察、债权债务及抵押物和担保的核实查验、法律关系有效性论证、核查资产瑕疵。

评估报价:资产价值的评估论证、寻找潜在买家。

委托处置:提出拆包或单项目的处置方案。

Services

The procedure of traditional purchasing and handling bad assets is as follows:

The intentional buyer first negotiates with the intention of purchasing bad assets pack with the bank. The, the bank offers one assets pack and a List of Assets, and requires the intentional buyer sign Confidentiality Agreement. Subsequently, the intentional buyer and the bank check conditions of pledged items and loan items in the assets pack; and the intentional buyer carry out due diligence personally. After the completion of the above procedure, the bank conducts bidding for the assets pack, after the assets pack is purchased via four AMC channels and subsequent assets handling is carried out.

Operational procedure: Project screening→ Due diligence → Assessment quotation → Acquisition→ Disposal

Considering hard work in pre-due diligence and the huge amount of work, a considerable quantity of local resources are entailed. Owing to non-transparent information and implicit ownership of assets ownership in the assets pack, the intentional buyer can hardly made effective judgment in the short term. Due diligence mainly includes legal due diligence and financial due diligence. Legal due diligence is mainly conducted to judge whether the assets have flaws in terms of debt rights, whether they are involved in other lawsuits and criminal cases. Financial due diligence is more complicated, covering whether debtor exists, the repayment of the assets’ principal and interest, borrower’s repayment ability, pledged item and conditions of guarantee, encashment ability of pledged item, circulation of disposal of pledged items and so on. The entire due diligence takes a long time, but with low efficiency.

The operational procedure of introducing bad assets service supplier is as below:

The intentional buyer first negotiates with the intention of purchasing bad assets pack with the bank. The, the bank offers one assets pack and a List of Assets, and requires the intentional buyer sign Confidentiality Agreement. Subsequently, the intentional buyer and the bank check conditions of pledged items and loan items in the assets pack; and the intentional buyer carry out due diligence personally. After the completion of the above procedure, the bank conducts bidding for the assets pack, after the assets pack is purchased via four AMC channels and subsequent assets handling is carried out.

Our company provides the following separate or comprehensive packaging services in the entire procedure of acquisition and disposal of bad assets pack as required by the client.

Service items in each specific part are as below:

Project screening: Project source, seller’s conditions, deficiencies of laws, potential return rate and preliminary report, analysis of competitors.

Due diligence: Investigation into background of debt rights and debts, on-site assets investigation, checking and inspection of debt rights, debts, pledged items and guarantee, verification of validity of legal relation and flaws of checked assets.

Assessment quotation: Assessment and verification of assets’ values, seeking potential buyers.

Entrusted disposal: Propose solution to de-packing or single item dismantling.